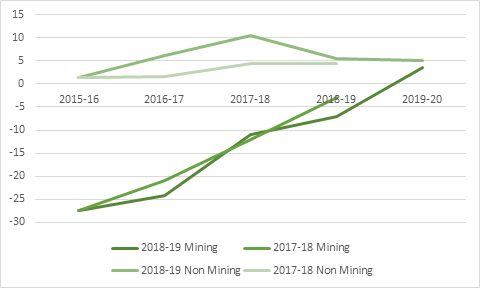

This is a budget that is seeking relying heavily on a dramatic uptick in business activity to support a reduced deficit, cuts in income tax and consistent real reduction in expenditure. This business activity is expected to be driven by continued solid investment in the non-mining sector and growth in the mining sector.

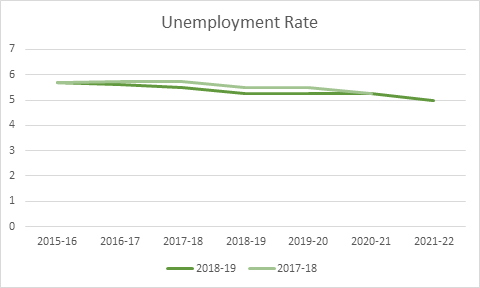

Figure 1: Investment Growth

The Economic Environment

The charts in Figure 1 highlight how similar the economic outlook is compared with last year’s budget.

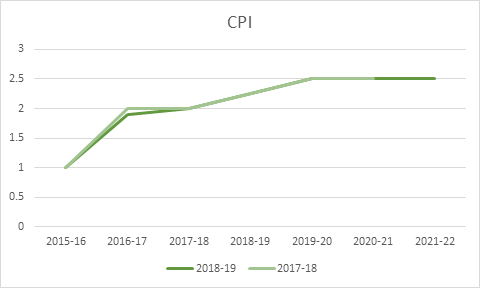

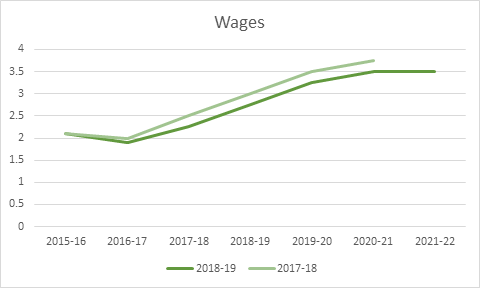

- GDP growth and CPI growth remain in line with the previous forecasts.

- Unemployment marginally lower, (by around 0.25%).

- Lower wage growth.

The personal income tax cut, highlighted by the Government, indicate that the government is seeking to achieve lower unemployment by providing an increasing share of workers disposable income.

Figure 2: Key Economic Statistics, Budgets 2018-19 v 2017-18

|

|

|

|

|

|

The global economy is expected to remain relatively unchanged compared with previous year’s budget, with the notable changes being stronger growth in Japan and US. While the budget does mention “recent tariff announcements by the US Administration, and fears that they may escalate, present uncertainties for both the US and global outlook”, this does not appear to be reflected in the numbers.

Personal income tax cuts

The key points about the personal income tax is that it will be introduced in stages, with lower income taxpayers being at the front of the queue as the cuts are rolled out over the coming years. The government has focussed on these tax cuts, restructuring their argument and allowing the corporate tax cuts which have commandeered so much political capital recently.